RCBs must digitise to stay competitive — ARB Apex Bank

The ARB Apex Bank has urged Rural and Community Banks (RCBs) to embrace digital transformation to remain competitive and relevant in the rapidly evolving banking sector. According to the Bank, customer expectations now prioritize convenience, accessibility, and real-time service delivery, making it imperative for RCBs to adopt innovative, technology-driven financial solutions.

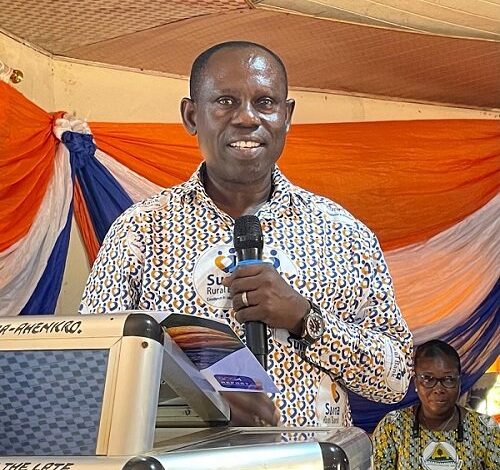

Ms. Suzan Boateng, Sunyani Branch Manager of ARB Apex Bank, speaking at the 39th annual general meeting of Suma Rural Bank PLC at Suma-Ahenkro in the Bono Region, encouraged RCBs to leverage digital platforms such as GhanaPay, ApexLink, and Agency, Internet, and Mobile banking services.

Representing the Managing Director, Mr. Alex Kwasi Awuah, Ms. Boateng noted that digital banking would allow RCBs to serve more customers efficiently, create new revenue opportunities, and utilise data to develop tailored financial products. She stated, “This cultural shift allows banks to serve more customers efficiently, generate new income streams, and gather valuable data to design tailored financial solutions.”

She further advised RCBs to strengthen credit risk management systems and improve loan portfolio quality, emphasizing that profitability and long-term sustainability are closely linked to effective credit risk control.

Presenting the bank’s report, Board Chairman Mr. Akwasi Afram highlighted Suma Rural Bank PLC’s strong performance for the 2024 financial year, reporting significant growth across all key performance indicators. Operating income increased by 41.7 per cent, rising from GH¢11,418,941 in 2023 to GH¢16,175,388 in 2024.

He attributed the growth largely to a 102 per cent increase in deposits, which moved from GH¢41,882,447 to GH¢84,609,653 during the period. Profit after tax rose significantly to GH¢3,425,653, representing a 120 per cent increase over 2023’s GH¢1,555,333.

Investments grew by 158 per cent, from GH¢24,070,000 to GH¢62,141,000, while loans and advances improved to GH¢18,008,695. The bank closed the year with shareholders’ funds of GH¢6,980,354, an 88 per cent increase from GH¢3,706,252 in 2023.

In recognition of the strong performance, the Board declared a dividend of GH¢0.15 per share, amounting to GH¢448,684.50 on 2,991,230 issued shares.

BY DANIEL DZIRASAH, SUMA-AHENKRO

🔗 Follow Ghanaian Times WhatsApp Channel today. https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q

🌍 Trusted News. Real Stories. Anytime, Anywhere.

✅ Join our WhatsApp Channel now! https://whatsapp.com/channel/0029VbAjG7g3gvWajUAEX12Q