Cedi to weaken slightly in quarter 4, but to end 2025 appreciating against dollar – Fitch Solutions

Fitch Solutions is anticipating a slight weakening of the Ghana cedi to the US dollar before the end of 2025.

The local currency has appreciated by over 29% against the American greenback in the retail market since the beginning of the year, and is on course to appreciate against the dollar for the first time in its history. It is presently going for GH¢12.00 to one dollar at the forex bureau and selling at GH¢10.92 on the interbank market.

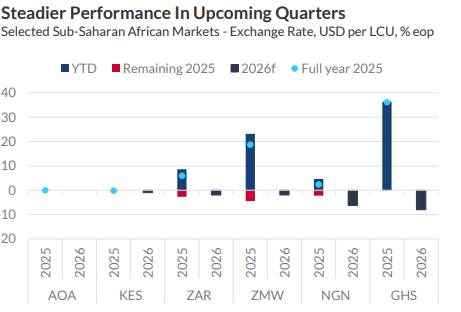

“We expect most major Sub-Saharan African currencies to remain broadly stable through quarter 4 2025 and into 2026, extending the calm observed year-to-date. Indeed, we anticipate only a slight weakening of the Ghana cedi, Zambia kwacha, Nigeria Naira and South Africa rand by the end of 2025

The UK-based firm is, however, predicting about 8% depreciation of the cedi against the US dollar.

It is therefore predicting GH¢11.70 on the interbank market by the end of 2026.

“While modest depreciation against the US dollar is likely in the coming quarters, currencies will remain far more stable than during the volatility experienced in 2023 and 2024”, it mentioned.

“We expect continued softness in the US dollar and robust risk appetite for emerging market currencies to add tailwinds to Sub-Saharan Africa forex.”

It continues that the price of gold will remain elevated due to policy uncertainty in the US, anticipated interest rate cuts by the Federal Reserve, and ongoing geopolitical tensions.

However, stronger reserves from high gold revenues, Bank of Ghana intervention and protecting export competitiveness will limit prolonged cedi gains.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link