Bank of Ghana to develop and test e-Cedi payment system – Vice President

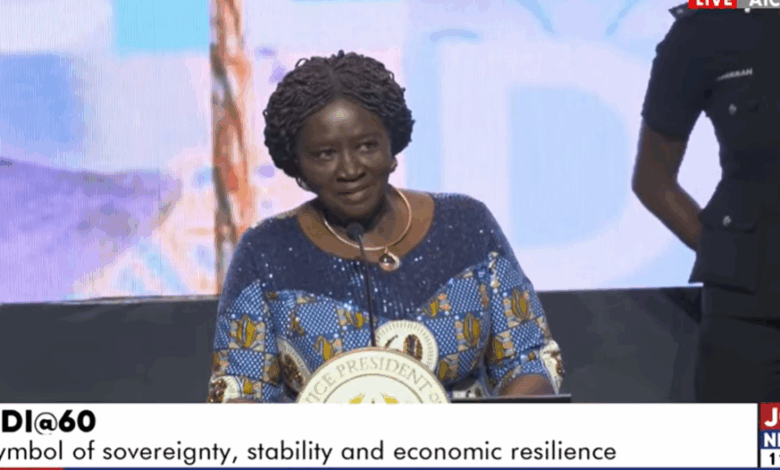

The Vice President, Professor Jane Naana Opoku-Agyemang, has announced that the Bank of Ghana will soon commence the development and testing of an electronic cash payment system, known as the e-Cedi.

She said this forms part of the government’s efforts to modernise the country’s financial sector.

The e-Cedi initiative was first explored in 2021 under the leadership of then-Governor Dr Ernest Addison. It is envisioned as a Central Bank Digital Currency (CBDC) designed to serve as a digital alternative to physical cash.

Speaking at the launch of the 60th Anniversary Celebration of the Cedi in Accra on Tuesday, the Vice President highlighted the potential of the e-Cedi to drive Ghana towards a more efficient and inclusive financial ecosystem.

“If the e-Cedi payment system is implemented, it will support the vision of a cashless economy, enhance financial inclusion, strengthen confidence in the cedi as Ghana’s sole legal tender, and ensure its continued relevance,” she said.

Professor Opoku-Agyemang noted that the rapid evolution of global finance underscores the need for Ghana to innovate.

“Finance is evolving rapidly, and that is why the Bank of Ghana is developing and testing the e-Cedi — the digital form of our currency. Once fully implemented, it will modernise our payment system and secure a cashless future, ensuring the cedi retains its importance,” she added.

The Vice President also urged the Governor of the Bank of Ghana and the Minister of Finance to collaborate closely with businesses, banks, and innovators to ensure a smooth rollout of the new payment system.

She further commended the Bank of Ghana, Deputy Governor Dr Johnson Pandit Asiamah, and Minister of Finance Dr Cassiel Ato Forson for their roles in maintaining macroeconomic stability and preserving public confidence in the national currency.

“Through prudent monetary policy and effective public engagement, the Bank has helped anchor expectations and restore a measure of credibility to our markets,” Professor Opoku-Agyemang remarked.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link