Ghana secures crucial Moody’s Upgrade—Debt Cut fuels hope, but vigilance is essential

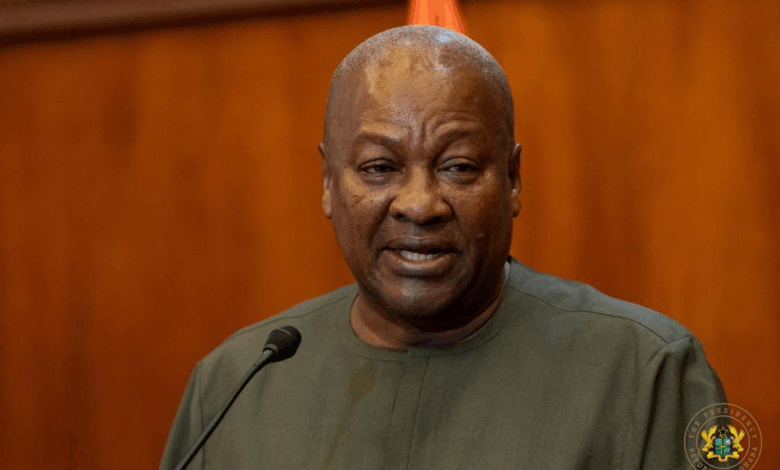

The upgrade by international ratings agency Moody’s of Ghana’s sovereign credit rating to Caa1 with a stable outlook signals a profound shift in the nation’s financial narrative. This move from Caa2, announced on Friday, October 10, 2025, acknowledges the courageous fiscal consolidation undertaken by the government under President John Mahama.

The numbers speak volumes: a dramatic reduction in public debt from GH¢764 billion (64.9% of Gross Domestic Product a year earlier), to GH¢629 billion, or 44.9% of GDP by end-July 2025. This debt diet, coupled with a surge in gross international reserves by 43% to $10.7 billion by end-August, has restored a measure of external financial resilience thanks to strong bullion prices.

The View from the Government

Acknowledging the hard work and the long road ahead, Minister of Finance, Dr. Cassiel Ato Forson, stated: “This upgrade is a direct validation of the difficult sacrifices Ghanaians have made. It is not an end-point, but a powerful indicator that our reforms are working. The stable outlook challenges us to stay the course—fiscal discipline is now the bedrock of our national economic policy.”

The Political Counterpoint: Skepticism from the Opposition

While the government celebrated the upgrade, the political opposition urged caution, tying the fiscal gains to severe austerity measures. An official from the main opposition New Patriotic Party (NPP), who requested anonymity to speak candidly, commented: “This ‘upgrade’ is bought with the blood, sweat, and tears of every citizen who has endured record-high taxes and frozen development projects. We congratulate the government for fulfilling Moody’s terms, but we will judge them by the cost of living, not by a letter on a balance sheet. The real upgrade will be seen when the unemployment figures start to fall, not before.”

What Does the Move from Caa2 to Caa1 Mean for the Market Woman?

For the average Ghanaian, a credit rating is often just a technical term. But the shift from Caa2 to Caa1 is important because it means the world’s financial experts no longer see Ghana as a country on the brink of collapse. Think of it this way: Caa2 meant Ghana was considered a patient with a severe, life-threatening condition and an immediate risk of default. The move to Caa1 signals that the patient has stabilized and is now in intensive care but recovering. While the country is still in a high-risk category, this change immediately lowers the panic among global investors, which is crucial for stabilizing the Cedi and reducing the cost of imported goods, directly easing pressure on household budgets.

A Beacon for Global Investors: Lowering Sovereign Funding Costs

For global investors, this upgrade is a beacon of policy credibility. It means Ghana, though still in a speculative rating band, is actively managing its debt, reducing the immediate risk of a default. This lessens refinancing pressure and will likely lead to lower sovereign borrowing costs in the medium term.

Moody’s upgrade could further enhance market sentiment, as the agency noted “Greater macroeconomic stability and favourable external dynamics are supporting more controlled funding costs.” This is already reflected in the domestic market: the government’s reduced borrowing has seen the 364-day Treasury bill rate drop to 12.9% by end-September. As Dr. Antoinette Sayeh, an international development expert, once said in a related context, “A country’s commitment to fiscal discipline is the single most important factor in sustaining investor confidence.” The stable outlook is Moody’s vote that the government will stay the course on its rigorous reforms.

The IMF Anchor: Accountability and Macroeconomic Stability

The core driver of this positive reassessment is Ghana’s commitment to the $3 billion Extended Credit Facility (ECF) program with the International Monetary Fund (IMF). Moody’s explicitly noted that the upgrade was “on the back of improved prospects for debt reduction and macroeconomic stabilisation under the country’s ongoing IMF-supported reform program.”

This IMF anchor provides an external layer of accountability, which significantly bolsters investor confidence. The program has been key to implementing prudent budget management and the Fiscal Responsibility Framework. The success is further evidenced by the IMF’s staff-level agreement for a $385 million disbursement. The Fund has “lauded Ghana’s progress in stabilising inflation, rebuilding reserves, and maintaining fiscal discipline,” indicating that the macroeconomic recovery is firmly taking hold. This partnership underpins Moody’s assessment that “Ghana’s debt metrics are on a clearer path toward sustainability.”

From Wall Street to the Streets of Accra: A Lifeline for Households and SMEs

The news must translate from technical financial jargon into tangible relief for the market woman and the unemployed youth. The most immediate and resonant impact for ordinary citizens is on inflation and the exchange rate. Ghana’s economic crisis had driven inflation to historic highs, shredding the purchasing power of the cedi. The improved credit rating externally validates the country’s macroeconomic stability. A more stable currency means cheaper imports—from fuel and spare parts to rice and medicines.

A crucial development is the drop in inflation to 9.4% in September, the country’s first single-digit rate since 2021. “We are tired of watching the cedi weaken every day. If this rating helps keep the cost of gari and petrol down, then it is good news for our homes,” said Kukua Dadson, a caterer in Accra.

For small and medium enterprises (SMEs), the decline in government borrowing rates directly feeds into lower commercial lending rates, offering a lifeline. “The high cost of borrowing was killing my business,” states Kojo Ofori, a small textile manufacturer. “If banks can now lend to us at reasonable rates, we can invest in new machines and hire more people. This rating should unlock local credit.” This is the critical next step: translating sovereign stability into private sector growth.

The Hard Truths and Lingering Risks

Economists caution against excessive celebration. While the upgrade is a key milestone, Ghana remains deep in the “Caa” territory, indicating very high credit risk. The success story hinges on sustained political will—a perennial risk in West African democracies.

The Fiscal Fragility

The fact that fiscal improvement was largely expenditure-driven—a “reset” of budgetary controls and a reduction in public debt—is commendable, but concerns persist about the quality and sustainability of revenue mobilization. Fiscal overruns have plagued previous budgets, and the political cycle always increases the temptation for spending. A senior economist at the University of Ghana, who asked to remain anonymous, warned, “The market is impressed now, but the structural weaknesses in revenue collection remain. We must aggressively tackle revenue leakages, not just cut essential spending, to maintain this momentum.”

Completing the Debt Puzzle

The upgrade is conditional on finalizing the external debt restructuring with private creditors. This remains a significant hurdle. Should negotiations falter, the stable outlook could quickly revert to negative. The government must demonstrate unflinching resolve to complete this final, difficult chapter of the debt cleanup, as Moody’s Investors Service noted this is “key to sustaining economic growth and completing debt restructuring efforts with private creditors.”

A Call to Vigilance and Hope

The Moody’s upgrade is a victory for discipline, a validation of the tough, often painful, decisions made in the last year. It is a moment for Ghana to reimagine its economic future—one built not on temporary commodity surges but on robust, transparent, and accountable governance.

Ghanaians should care because this technical indicator directly affects their economic destiny. It is a testament to the collective sacrifice made during the austerity program. The hope is that this hard-earned confidence from the international community will be met with fierce domestic vigilance to ensure the gains are not squandered. President Mahama must not just maintain fiscal prudence; he must institutionalize it, making it a permanent feature of Ghana’s economic management to ensure this “turnaround” becomes an unshakeable economic foundation.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link