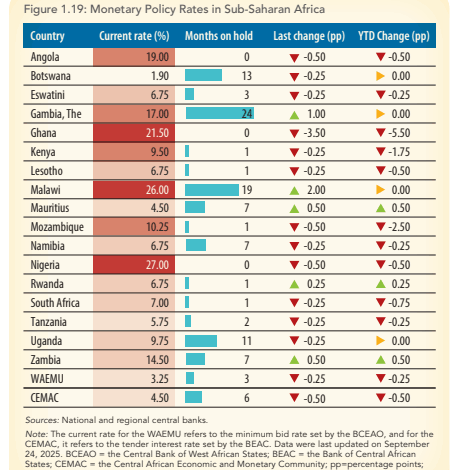

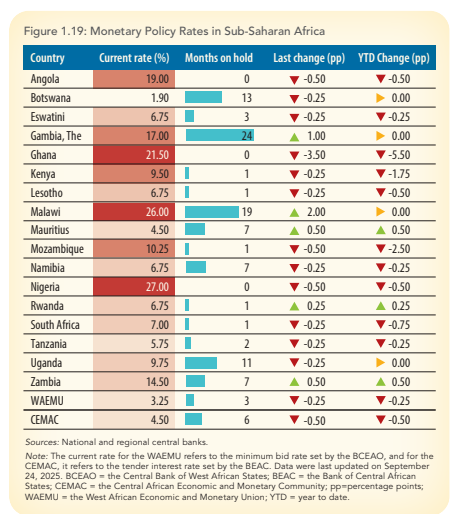

Ghana ranked 3rd in Sub-Saharan Africa with highest policy rate

Ghana ranks 3rd in Sub-Saharan Africa with the highest policy rate, the World Bank has disclosed in its October 2025 Africa Pulse Report.

This is coming despite the 7.5 percentage points drop in the policy rate since January 2025. The Bank of Ghana has attributed the cut in the policy rate to a sharp fall in inflation which is currently hovering in the single digit bracket.

Nigeria ranked 1st with the highest policy rate in Sub-Saharan Africa with a rate of 27%.

It is followed by Malawi with a rate of 26.0%.

Meanwhile, Botswana has the best and lowest policy rate in the region with a rate of 1.90%.

The World Bank said most of the regions central banks have either cut interest rates (Kenya, Mozambique, Lesotho and South Africa) or paused their contractionary monetary policy for several months (Angola, Botswana, Malawi, Rwanda and Uganda).

“Other central banks in the region have recently raised rates due to a slight resurgence of inflation this year, namely Mauritius and Zambia”, the report stated.

It continued that potential headwinds from global economic uncertainty including sharp fluctuations in commodity prices and restrictive trade policies, domestic and regional conflicts and political instability as well as fiscal slippages may heighten inflationary pressures and risk delays in monetary policy normalization.

The Monetary Policy Committee (MPC) of the Bank of Ghana (BoG) in September 2025 cut the rate at which it lends to commercial banks, by 350 basis points to 21.5%, the lowest since October 2022.

The central Bank attributed the cut in the rate to sustained disinflation, robust growth and stronger external buffers.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link