Fidelity Bank champions responsible AI adoption at Landmark Pan-African Summit

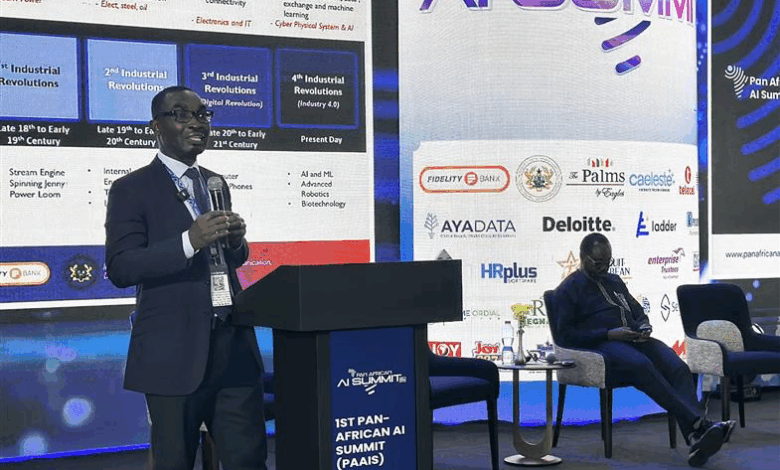

Simon Adu-Gyamfi, Chief Support Officer, Fidelity Bank, delivering a presentation on Adoption of AI at the Work Place

Fidelity Bank Ghana has reaffirmed its commitment to driving responsible innovation and shaping the future of digital transformation in Africa by participating in the maiden Pan-African Artificial Intelligence (AI) Summit.

It was held under the theme “Unifying Africa Through Artificial Intelligence.”

As a sponsor of this historic gathering, which convened thought leaders, policymakers, entrepreneurs, innovators, and researchers from across the continent and the diaspora, Fidelity Bank underscored its position at the forefront of harnessing emerging technologies to deliver greater value to customers and communities.

Representing the bank, Simon Adu-Gyamfi, Chief Support Officer, shared Fidelity’s unique approach to AI adoption, which he described as “AI as a CEO”, a philosophy that positions AI not as a distant tool but as a leadership companion embedded in everyday operations.

“For us, AI is not about grand theories but practical steps that transform how we work and serve. It begins with empowering our people, refreshing our culture, and putting technology at the heart of everything we do,” Mr Adu-Gyamfi noted.

He highlighted Fidelity’s deployment of Robotic Process Automation (RPA) as a case study, revealing that within a short period, productivity in reconciliations and general ledger activities had increased by over 200% without the need for additional human resources.

Instead, staff have been freed to focus on high-value tasks, improving both operational efficiency and employee fulfilment.

The bank has also recorded significant financial benefits, with its AI-enabled processes already yielding significant savings.

Mr Adu-Gyamfi explained that Fidelity’s AI journey is still unfolding, with the next phase focused on embedding AI within core banking systems and scaling use cases across business lines.

“This is a journey of baby steps, starting with pilots that build confidence and governance structures that ensure we use AI responsibly. Already, we are seeing excitement across the organisation as staff bring forward innovative ideas that can be scaled,” he added.

Also speaking at the summit was Ms Edna Engmann, Fidelity’s Head of Transformation Programmes, who emphasised the importance of innovation labs and co-creation in solving Africa’s pressing challenges.

“We no longer want innovation to stop at ideas. At Fidelity, when someone proposes a solution, we walk the journey with them, testing, refining, and ensuring it meets the customer’s needs.

“This collaborative approach is unlocking the potential of our people and unleashing solutions that matter,” she said.

Ms Engmann further noted that AI has a critical role to play in inclusive banking, particularly in breaking down language barriers and enabling digital access for underserved populations.

She pointed to opportunities in voice banking in local dialects and digital literacy training for rural communities as key areas Fidelity is actively exploring.

The inaugural Pan-African AI Summit marked a turning point in aligning Africa’s digital future with local realities, and Fidelity Bank’s contributions reflected its broader mission of making technology work for people at every level of society.

As Mr Adu-Gyamfi concluded, “AI is not the future; it is already here. The question is how we, as African institutions, shape it to uplift productivity, inclusion, and ultimately, the quality of life for our people.

“At Fidelity, we see AI as a lifeline for the future, embedded in the way we serve our customers and drive progress.”

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link