How Fidelity Bank’s GTIC is equipping young innovators to build a climate-smart agricultural sector

Ghana’s agricultural sector, a cornerstone of its economy, has long been a story of immense potential held back by persistent challenges. For generations, farmers have battled with the unpredictable nature of the weather, significant post-harvest losses, and limited access to modern farming methods and financial support. These problems represent the real struggles of small-holder farmers and the missed opportunities for a nation’s growth.

Today, we stand at the intersection of opportunity and urgency.

According to the World Bank’s Commodity Markets Outlook and Agricultural Risk Assessment, agriculture is a US$4.82 trillion industry in 2025, projected to grow steadily at 3.44% Compound Annual Growth Rate, driven by demand for food, biofuels, and sustainable commodities. However, the sector faces risks from climate change, input costs, and geopolitical tensions, making innovation and resilience more critical than ever.

In Africa, agriculture remains the backbone of economies. As reported by the World Bank’s West Africa Digital Agriculture Projects, the connected agriculture market alone is expected to grow from US$2.9 billion in 2025 to US$9.87 billion by 2031, as digital platforms revolutionise access to markets, finance, and advisory services for smallholder farmers.

In Ghana, the agriculture sector is valued at US$15.2 billion in 2025, with a projected growth rate of 7.01% Compound Annual Growth Rate, fueled by urbanisation, mechanisation, and digital transformation. A year ago, Fidelity Bank, through its Young Entrepreneurs Initiative, decided to tackle these deep-rooted problems head-on. They did this to support a new way of thinking. This led to the launch of the GreenTech Innovation Challenge (GTIC), a program designed to empower young minds in the use of technology to transform agriculture.

The Story of Impact

The inaugural GreenTech Innovation Challenge (GTIC) was a journey of transformation, designed to turn untapped potential into market leadership. In partnership with InnoHub Foundation, Fidelity Bank invested GH¢1,400,000 in 17 brilliant young entrepreneurs. This funding was strategically deployed to both nurture innovative ideas and provide critical scale-up capital for existing commercial ventures ready to expand their impact. The problem was clear: How do we use technology to make farming more resilient, efficient, and profitable for everyone?

Derrick Awumey, the founder of AgricCom Assurance, saw the vulnerability of farmers to climate risks. His solution? A service that provides smallholder farmers with insurance, protecting them from the financial devastation of drought or floods. The GTIC was instrumental in helping him refine his business model, connecting him with key players in the ecosystem, and helping him shape a viable and sustainable business.

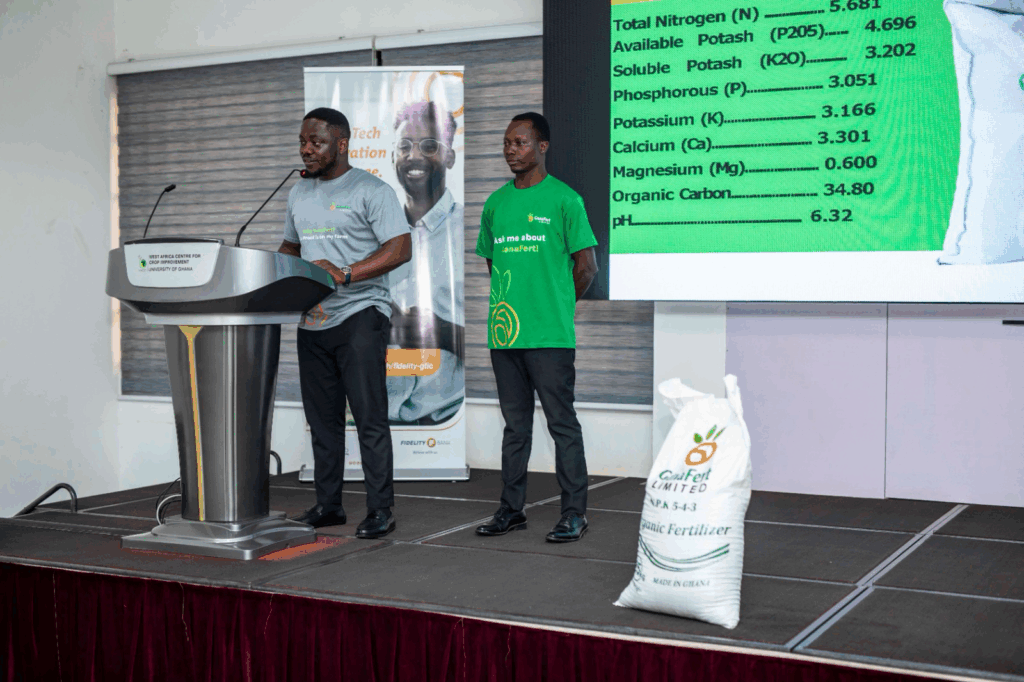

Another innovator, Emmanuel Acquah of AgriMercab, was on a mission to solve the problem of organic waste. He saw the potential to turn waste into valuable resources like animal feed and fertiliser. Before the GTIC, his operation was limited, processing only two tons of waste monthly. With the support from the challenge, he was able to expand significantly, jumping to processing six tons of organic waste monthly. The grant also enabled him to invest in solar panels, a leap towards a sustainable, mechanised process. This is a powerful example of how solving one problem, like waste management, can create a solution for another: a sustainable supply of agricultural inputs.

For Abdallah Salia of Farmitecture, the challenge was addressing the disconnect between urban living and fresh, healthy food. His company provides urban farming systems for people with limited space. The capital boost from the GTIC was a game-changer, transforming his “demo farm idea into reality” and allowing for crucial product development to make his systems more market-ready.

The GTIC also supported established businesses like Axis Drone Surveys, led by Derrick Annan. He recognised the lack of reliable data for farmers, a critical barrier to modern, efficient farming. His drone services provide farmers with the data they need to make informed decisions. The program didn’t just support his current operations; it helped him think bigger, providing a roadmap to expand into new markets like Tanzania.

And then there’s Violet Amoabeng of Skin Gourmet. Her company makes raw, handmade skincare from wild-sourced Ghanaian ingredients. While seemingly unrelated to agriculture, her work highlights the potential of value addition and a robust supply chain. The GTIC grant helped her strengthen her supply chain and expand her reach and impact, ensuring that the investment made would continue to benefit the community.

These are just a few of the 17 success stories from the first cohort. The numbers speak for themselves: these businesses collectively generated over GHS 13 million in revenue, created 49 new jobs, and raised an additional GHS 597,000 in funding. These represent real lives transformed, communities empowered, and a more resilient agricultural sector taking root.

The Next Chapter: Cohort 2 and Beyond

Following the remarkable success of the first cohort, Fidelity Bank is now preparing for GTIC Cohort 2. Building on what they’ve learned, they are focusing on identifying and empowering a new wave of innovative entrepreneurs.

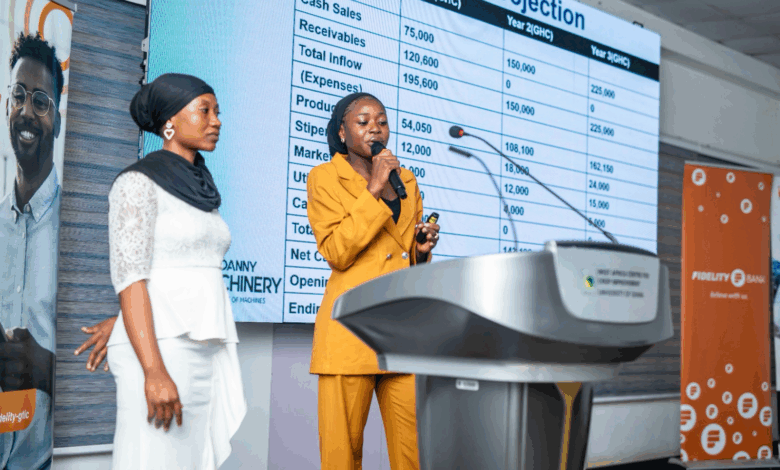

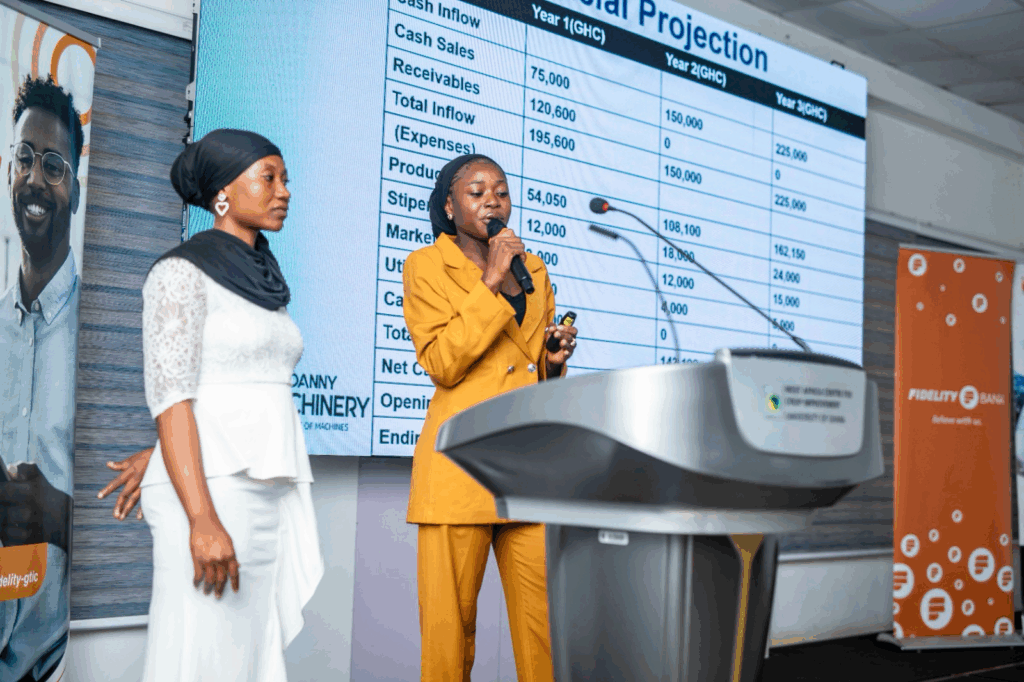

This time around, the challenge is concentrating exclusively on early-stage businesses (the Ideation Tier). The bank is providing over GHS 1 million in grant funding and support to 16 selected enterprises, with the top three receiving GH¢200,000, GH¢100,000, and GH¢70,000, respectively. This strategic shift is designed to nurture disruptive concepts, accelerate early validation, and build collaborative teams from the ground up.

The focus areas for this new cohort remain vital to Ghana’s agricultural future, including:

• Precision Agriculture: Enhancing crop monitoring and resource management.

• Post-Harvest Management: Innovations to reduce losses and add value.

• Digital Finance Services: Improving financial access for farmers.

• Climate-Smart Agriculture: Promoting sustainable farming practices.

• Value Chain Optimisation: Enhancing the efficiency and profitability of the entire agricultural process.

The success of the first cohort, and the commitment to a second one, shows a clear message: the problem isn’t a lack of brilliant ideas; it’s a lack of the right partnerships and support to turn those ideas into reality. Fidelity Bank’s approach is about seeing the potential in people, investing in their solutions, and helping them build a future where Ghana’s agriculture is not just a source of food, but a source of innovation and prosperity.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link