The Atlantic Lithium (Ewoyaa project) deal: Why the Parliament of Ghana must not ratify a flawed agreement

Two years on, with the project still stalled and a revised agreement now set to be tabled before Parliament, the question is not whether Ghana should ratify quickly, but whether it should ratify wisely. To do otherwise would be to repeat history’s mistakes with eyes wide open.

When Ghana first announced its landmark lithium mining lease with Atlantic Lithium Ltd, the news was greeted with fanfare. Officials hailed it as “unprecedented” and “transformational,” promising that the Ewoyaa project would usher in a new era of resource driven prosperity.

Yet, as IMANI Africa cautioned in its December 2023 analysis, beneath the celebratory headlines lay a contract riddled with structural weaknesses.

At the heart of IMANI’s critique was the issue of pricing and offtake risk. The definitive feasibility study (DFS) for Ewoyaa assumed a long term lithium concentrate price of US$1,500 per tonne. At the time, spot prices were soaring above US$2,800 per tonne, creating the illusion of windfall revenues.

Yet since then, global lithium prices have collapsed, with spodumene concentrate trading around US$900 per tonne in late 2025. This dramatic swing exposes the fragility of Ghana’s fiscal take when royalties are tied to the operator’s “realized sales price” without independent benchmarks.

If Parliament ratifies a new agreement without indexed pricing safeguards, Ghana risks locking itself into a revenue model that evaporates whenever markets turn, leaving the nation poorer while related party offtakers (Piedmont/Elevra Lithium) quietly profit.

Equally troubling is the vagueness of beneficiation commitments, now compounded by the findings of the feasibility study. The study concluded that building a refinery or processing plant at Ewoyaa would not be economically viable unless at least three mines of similar scale were developed in Ghana, or unless government provided significant incentives to offset costs.

In other words, the promise of local refining was never realistic under current conditions. Parliament must therefore insist on clarity: either secure concrete commitments to co develop additional mines and provide incentives that make refining viable, or admit openly that beneficiation will not happen under the present structure. To ratify another aspirational clause is to ratify a mirage.

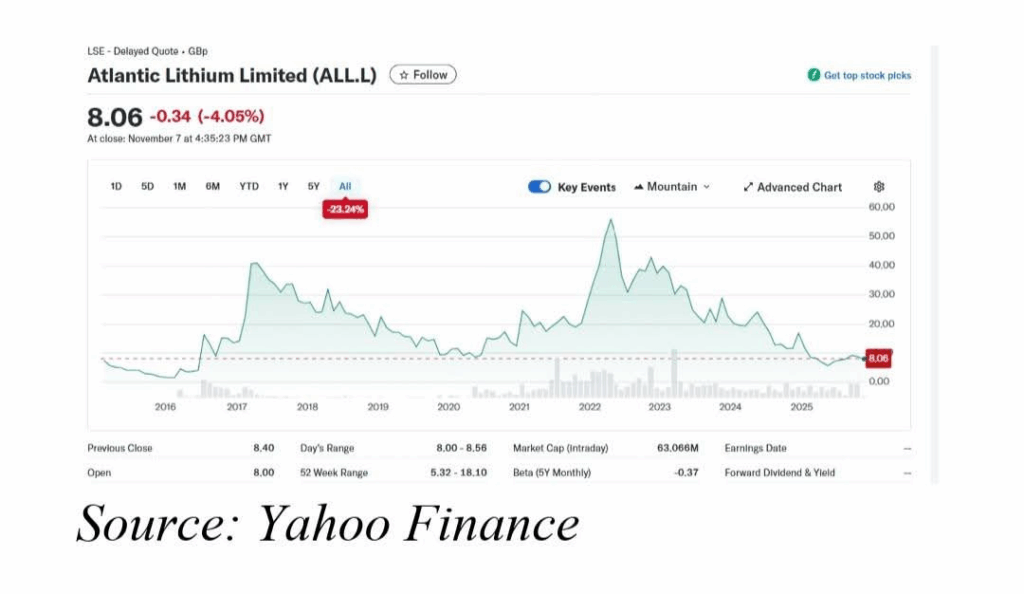

Source: Yahoo Finance(first image attached)

The profile of the operator itself also demands caution. Atlantic Lithium is a junior miner with limited cash reserves and a volatile share price. Its dependence on Piedmont (Elevra) and sovereign investors like the Minerals Income Investment Fund (MIIF) exposes Ghana to execution risk.

The two year delay in breaking ground is not simply bureaucratic; it reflects the fragility of a small operator navigating volatile markets. Parliament must therefore embed performance covenants, financial close deadlines, and step in rights to protect the Republic if milestones are missed. Ratifying without such safeguards would be to gamble national resources on a partner ill equipped for the scale of the task.

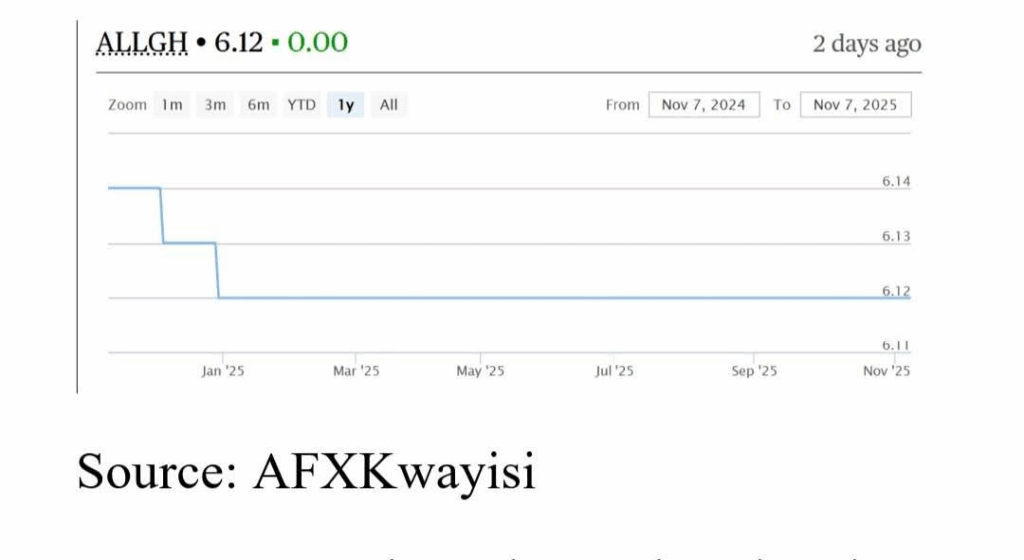

Source: AFXKwayisi (second image attached

MIIF’s entry into the project has been presented as a patriotic win, but here too caution is warranted. Sovereign capital must be protected against dilution, inconsistent valuations, and premature claims of “capital gains.”

The downturn in lithium prices has already exposed the fragility of earlier optimism. Parliament should demand anti dilution clauses, board rights, and staged capital commitments tied to clear project milestones. Without these protections, MIIF risks becoming a passive investor in a speculative venture rather than a strategic guardian of Ghana’s mineral wealth.

Finally, the broader geopolitical and technological context cannot be ignored. Lithium markets are volatile, battery chemistries are evolving, and recycling is advancing rapidly. A rigid contract that locks Ghana into outdated terms will leave the country stranded as global supply chains shift.

Parliament must therefore insist on adaptive clauses—royalty bands that adjust with market conditions, renegotiation triggers tied to technological pivots, and rights of first refusal for downstream refining and recycling. To ratify without such real options is to mortgage the future for short term applause.

In sum, the two years since the original lease was signed have vindicated every major concern raised in IMANI’s 2023 analysis. The project has not broken ground, pricing risks remain unresolved, beneficiation commitments have been proven unfeasible under current conditions, and the operator’s fragility is more visible than ever.

Parliament now faces a historic choice: to rubber stamp a revised agreement that repeats the flaws of the past, or to demand a contract that secures Ghana’s rightful share of value across the lithium supply chain. The delay has given Ghana leverage. To squander it would be unforgivable.

As the new agreement comes before Parliament, the caution is clear: ratify only if the concerns are addressed in substance, not in slogans. Anything less would be to ratify not progress, but peril.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link