Bank of Ghana’s new FX framework: A step toward predictability and market confidence

Ernestina Mensah – CA, CIMA, ACI Head, Market Risk – Bank of Africa Ghana Founder, Glimmer of Hope Foundation

The Bank of Ghana (BoG) on November 11, 2025, approved a new Foreign Exchange Operations Framework designed to clarify the objectives and principles guiding its interventions in the foreign exchange market. This initiative reinforces BoG’s commitment to maintaining macroeconomic stability under its inflation-targeting mandate and a flexible exchange rate regime, where the exchange rate remains market-determined.

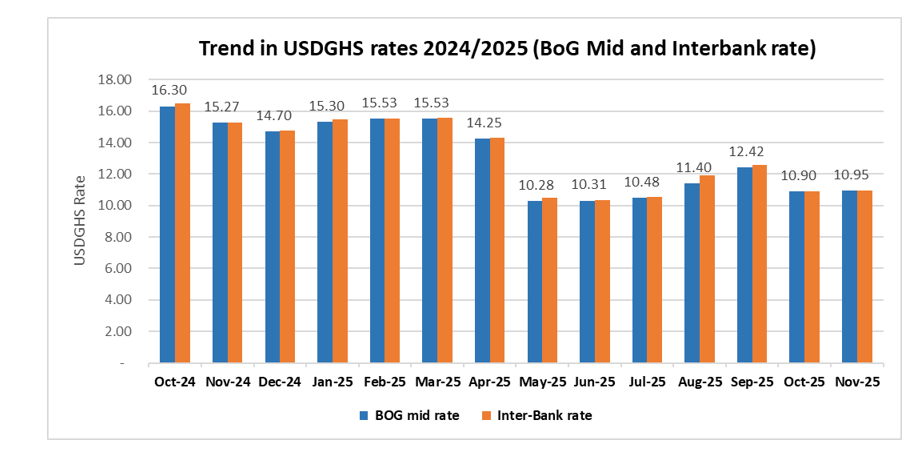

This policy step is both necessary and long overdue. Despite the cedi’s impressive recovery in 2025, volatility has been a constant companion. Within just months, the currency moved from about GHS 15.6 per dollar in March to GHS 10.1 in May, before weakening again to around GHS 13.0 by August. Such unpredictable swings have made planning difficult for both individuals and businesses.

To illustrate, consider the story of Albert, a professional who had two work trips abroad this year. For his first trip in May, Albert purchased USD 10,000 in March at GHS 15.64 paying GHS 156,400. Just a weeks later, the cedi strengthened dramatically to GHS 10.20 per dollar. Had he waited, he would have spent only GHS 102,000 a difference of GHS 54,400, equivalent to losing roughly one-third of his cedi value within weeks.

Learning from that, Albert decided to wait before buying for his second trip in September. But the market turned again: by August, the rate had risen to GHS 13.00. To fund another USD 10,000, he now paid GHS 130,000 — GHS 28,000 more than he would have paid had he exchanged at the June/July peak. In short, whether he bought early or late, the volatility cost him dearly both times.

Albert’s experience mirrors what happens in the broader economy. Traders, importers, and manufacturers face the same uncertainty. When the cedi strengthens, consumers expect prices to drop but traders hesitate, citing unstable rates and old stock purchased at higher costs. “If we reduce prices and the rate climbs again, we lose everything,” one importer explained. The result is a market where gains in the cedi rarely translate into lower prices because volatility clouds visibility.

This is why BoG’s new FX framework is such a crucial intervention. It aims to replace uncertainty with predictability and opacity with transparency. Rather than reacting suddenly to market pressures, the framework sets out clear, rule-based, and pre-announced operations that signal to the market when and how BoG will engage. Its goal is not to fix or “defend” the cedi but to manage liquidity in a way that smooths volatility and fosters confidence.

Naturally, this has raised an important question: What’s the difference between “propping up” the cedi, which BoG says it will not do, and “market intermediation,” which the new framework supports?

| Aspect | Propping Up the Cedi | Market Intermediation (BoG’s New Approach) |

| Intent | To control or fix the exchange rate, keeping the cedi artificially strong or within a narrow band. | To smooth FX liquidity and ensure orderly market functioning without targeting a specific rate. |

| Timing | Reactive interventions occur suddenly when pressure mounts. | Rule-based and pre-announced auctions planned in advance. |

| Transparency | Limited; markets rarely know when or why BoG intervenes. | Clear, data-backed communication with published details on timing and amount. |

| Effect on Market | Distorts true demand and supply, masking fundamentals. | Promotes price discovery while cushioning against short-term shocks. |

This is not a semantic shift but a structural one. It marks a transition from firefighting to foresight a move toward modern central banking standards where markets can anticipate, interpret, and plan.

For businesses, this predictability will improve pricing decisions, risk management, and supply planning. For households, it will mean less anxiety about sudden currency movements that erode purchasing power. And for the broader economy, it sets the tone for stability that supports investment, employment, and real growth.

The success of this framework, however, will depend on consistent implementation. Credibility will rest on BoG’s discipline in following its own rules and communicating clearly with the market. But if executed faithfully, this could mark a turning point moving Ghana’s FX market from reactive uncertainty to measured confidence.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Tags:

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link