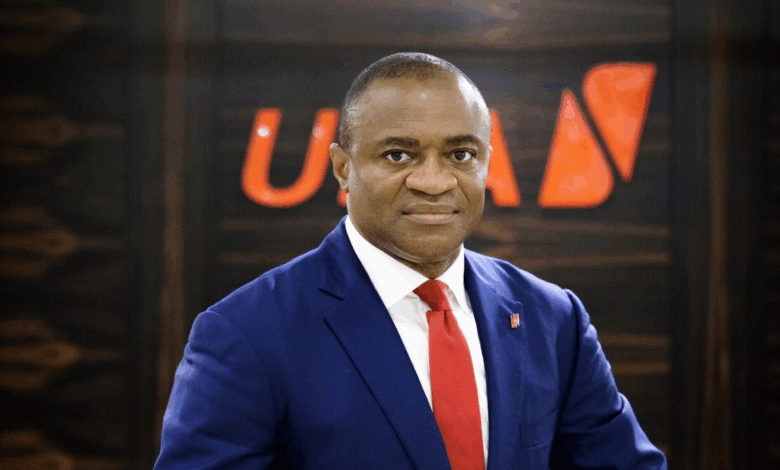

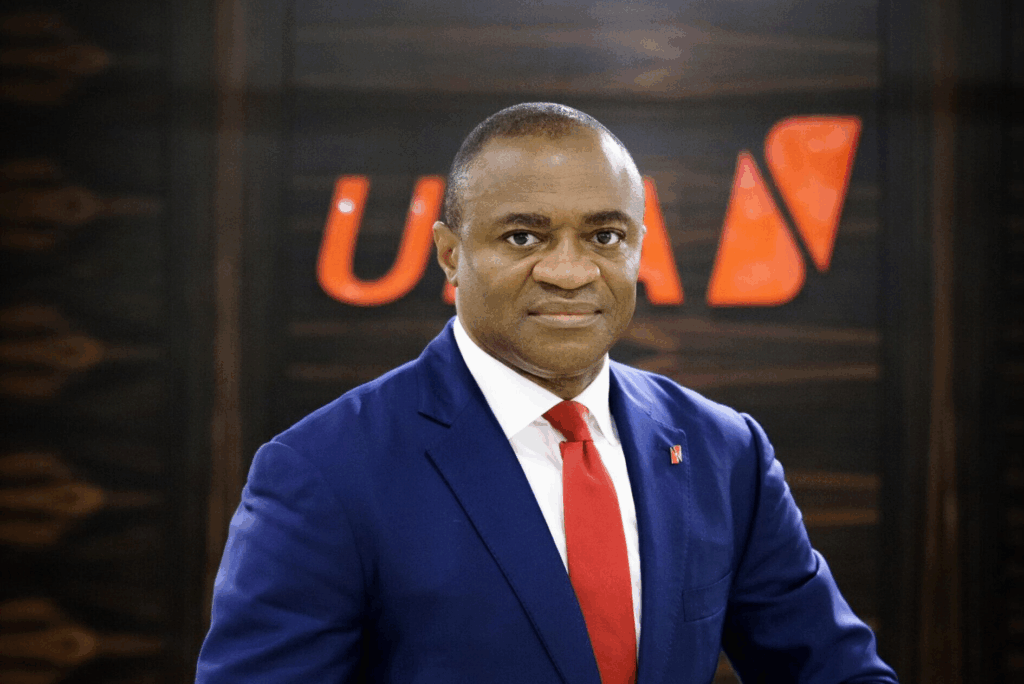

We are committed to highest standards of governance and compliance – Group CEO UBA assures

The Group Chief Executive of United Bank for Africa (UBA) has assured that the bank remains fully committed to the highest standards of governance and regulatory compliance in every market it operates.

Oliver Alawuba disclosed this in an exclusive interview with JOYBUSINESS in Washington, D.C., during the launch of the bank’s groundbreaking White Paper, Banking on Africa’s Future: Unlocking Capital and Partnerships for Sustainable Growth.

The assurance comes shortly after the Bank of Ghana announced on October 17, 2025, that it had lifted the suspension of UBA Ghana Limited’s Foreign Exchange trading license, effective October 19, 2025.

Demonstrating Compliance in Global Markets

Mr Alawuba emphasised that compliance is taken very seriously at UBA and the bank will continue to uphold regulatory standards.

He highlighted UBA’s operations in the United States as a testament to the bank’s commitment.

“UBA is one of the few African banks with a presence in one of the most regulated markets in the world. That should convince our clients everywhere, including Ghana, about our commitment,” he said.

He further noted, “The US has one of the highest levels of regulations, and UBA is fully compliant.”

The Group CEO also stressed the bank’s dedication to professionalism, financial strength, and resilience.

Background

On September 4, 2025, the Bank of Ghana announced that UBA Ghana’s forex license would be suspended for one month, effective September 18, citing multiple violations of foreign exchange market regulations.

These included breaches of the Updated Guidelines for Inward Remittance Services by Payment Service Providers, 2023, as amended by Notice No. BG/GOV/SEC/2025/25.

The suspension affected all remittance partnerships between UBA Ghana and DEMIs, PSPs, and MTOs.

On October 17, 2025, the Bank of Ghana lifted the suspension of UBA Ghana’s Foreign Exchange trading license, effective October 19, 2025.

The Central Bank noted that this decision followed UBA’s adherence to the conditions imposed during the suspension and the satisfactory implementation of remedial measures.

UBA’s Operations in Ghana

In his interview with JOYBUSINESS, Mr Alawuba outlined UBA’s plans to expand its presence across Ghana and support digitalisation efforts nationwide.

He also highlighted the bank’s commitment to assisting small and medium-sized enterprises (SMEs) in expanding and growing their businesses.

“We want to play a lead role in service delivery in the country,” he said. “As a bank, we also want to link Ghanaian businesses to all the markets that operate globally.”

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link