Fidelity Bank urges policy-finance alignment to transform Ghana’s energy sector

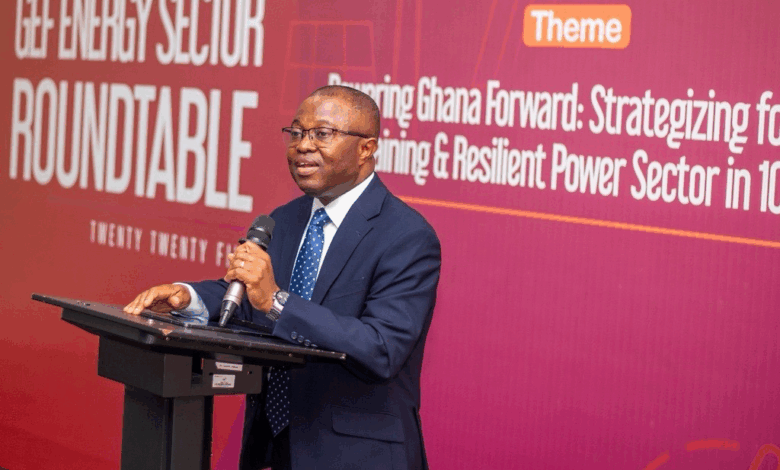

Atta Yeboah Gyan, Deputy Managing Director for Operations & Support Functions at Fidelity Bank

Fidelity Bank Ghana has positioned the structural challenges facing the country’s energy sector as a critical national imperative that demands immediate, sustained reform and disciplined capital.

Speaking at the B&FT Thought Leadership Series Energy Roundtable, Atta Yeboah Gyan, Deputy Managing Director for Operations & Support Functions at Fidelity Bank, stressed that fixing the energy sector is not a matter of choice, but a necessity for Ghana’s destiny.

The event, themed “Powering Ghana Forward: Strategising for a Self-Sustaining and Resilient Power Sector in 10 Years,” provided a platform for Mr Gyan to offer a candid assessment of a power sector currently weighed down by over $3 billion in legacy debt and liquidity challenges.

“If we are to be honest with ourselves, Ghana’s power sector stands today as both an emblem of progress and a mirror of strain,” Mr Gyan stated.

He attributed the strain to a vicious cycle of inefficiencies, including delayed tariff adjustments, non-payment by public entities, and a weakened Cedi that inflates energy costs.

“What Ghana’s power ecosystem needs today is not more temporary fixes, but sustainable financing structures, underpinned by transparency, innovation, and collaboration,” he asserted, positioning the financial sector’s involvement as being as much about capital discipline and governance as it is about generation capacity.

Drawing from the Bank’s extensive experience in corporate and project finance, Mr Gyan highlighted that the energy challenge is not just about generation capacity but also about capital discipline, governance, and transparency.

He cited the role financial institutions like Fidelity Bank played through initiatives like the Energy Sector Levies Act (ESLA) bonds, which provided temporary relief to liquidity pressures.

However, he stressed the need for more sustainable financing models that are rooted in data-driven decision-making and institutional accountability.

Mr. Gyan called for deeper collaboration between the financial sector, policymakers, and energy operators to deliver a power system that works for both consumers and investors.

He outlined several priority areas for action, from smart investments in renewable and hybrid systems to the digitisation of collections and the gradual expansion of smart metering systems to plug revenue leakages.

“Digitisation and data transparency must be prioritised to build trust across the value chain,” he added.

“Equally important is the establishment of clear, cost-reflective pricing frameworks that give investors and financiers the confidence to commit long-term capital.”

Reaffirming Fidelity Bank’s position as a leader in sustainable finance, Mr Gyan announced that the Bank is aligning its financing framework to actively support Ghana’s clean energy transition.

He noted that Fidelity has already introduced renewable asset financing products to empower individuals and businesses to adopt cleaner energy solutions.

The Bank is also exploring innovative tools such as green financing, blended capital, and ESG-linked instruments to scale up investments in renewable energy and strengthen local energy businesses.

Closing his remarks, Mr Gyan urged greater alignment among policy, finance, and purpose to transform Ghana’s energy sector into one defined by resilience, efficiency, and inclusivity.

“The challenges before us are complex, but not insurmountable,” he said.

“At Fidelity Bank, we remain committed to walking this journey with Ghana; to power homes and industries, but, more importantly, to power confidence, productivity, and growth.

Together, we can build an energy sector that is not just functional, but future-ready”

The 2025 Energy Roundtable brought together key stakeholders across the public and private sectors, including energy producers, regulators, financiers, and development partners, to deliberate on financing pathways for Ghana’s sustainable energy future.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link