Uncategorized

Bright Simons punches holes in Gold-for-Oil (G4O) scheme — A simple must-read explanation

- Okay, let’s talk about Gold-for-Oil (G4O).

- In late 2022, the government of Ghana announced that the country would use its gold resources to cover refined fuel (“petrol”/gasoline & diesel) imports.

- Internationally, this was seen as part of the de-dollarisation trend. Locally, it was sold as a big innovation: the pressure on the currency will reduce because Ghana will use gold, instead of dollars, to import fuel.

- Given that gold is a highly “dollar-liquid” asset, it was never clear why Ghana won’t simply sell the gold for dollars and use that to cover its ~$4 billion annual refined fuel import bill.

- It became clear over time that this was exactly what Ghana was, in fact, doing. There was nothing innovative whatsoever about the model. However, it did involve altering conditions in the fuel import market to an extent. That is what I want to talk about today.

- Ghana has an “almost liberalised” fuel market. Licenced private companies called BDCs can bring in fuel under the watchful regulatory eye of the NPA.

- Because the forex market is also only partly liberalised, the central bank (BoG) regularly steps in to auction dollars to the BDCs to augment what the commercial banks can provide for fuel imports.

- Just before G4O launched, the government, through the BoG, had taken a decision to capture more of the dollars that gold exports generate. It could have thus decided to simply supply more dollars to BDCs in open auctions if dollar supply was tight in the forex market.

- Instead, the government decided to support the state owned BDC, BOST, to import more fuel and increase its market share.

- One possible policy justification might have been that BOST would increase competitive pressure in the industry, strategically lowering prices and smoothing supply bumps.

- During the G4O era, the BoG supplied ~$1.63 billion to BOST’s suppliers outside the auction system in a highly opaque arrangement that has never been transparently explained.

- In effect, a simple process of selling dollars to fuel importers became a highly opaque gig in which BoG liquidated gold for dollars through unknown brokers and then funnelled the cash to mostly obscure fuel traders to supply BOST under shady terms. Some of the companies that got the gigs to supply fuel had zero track record in the industry. Indeed, one of them is now subject to criminal proceedings in London for its role in the G4O saga.

- Unsurprisingly, the BoG reported foreign exchange losses that exceed 2.1 billion GHS.

- In addition to whatever fees were paid to the mystery middlemen, the forex losses were some counterparties’ gain. In essence, someone was laughing to the bank.

- Not to talk of IMANI’s and partners’ announced findings (this week) of suspected graft and crooked dealings. (The authorities have been petitioned to order a full, transparent, end-to-end forensic audit into G4O, with CSOs observing.)

- In March 2025, the BoG terminated its involvement in G4O. In the 6 months since termination, and reversion to standard dollar auctions, life goes on as normal. No shortage at the pumps, no crazy hikes in the dollar.

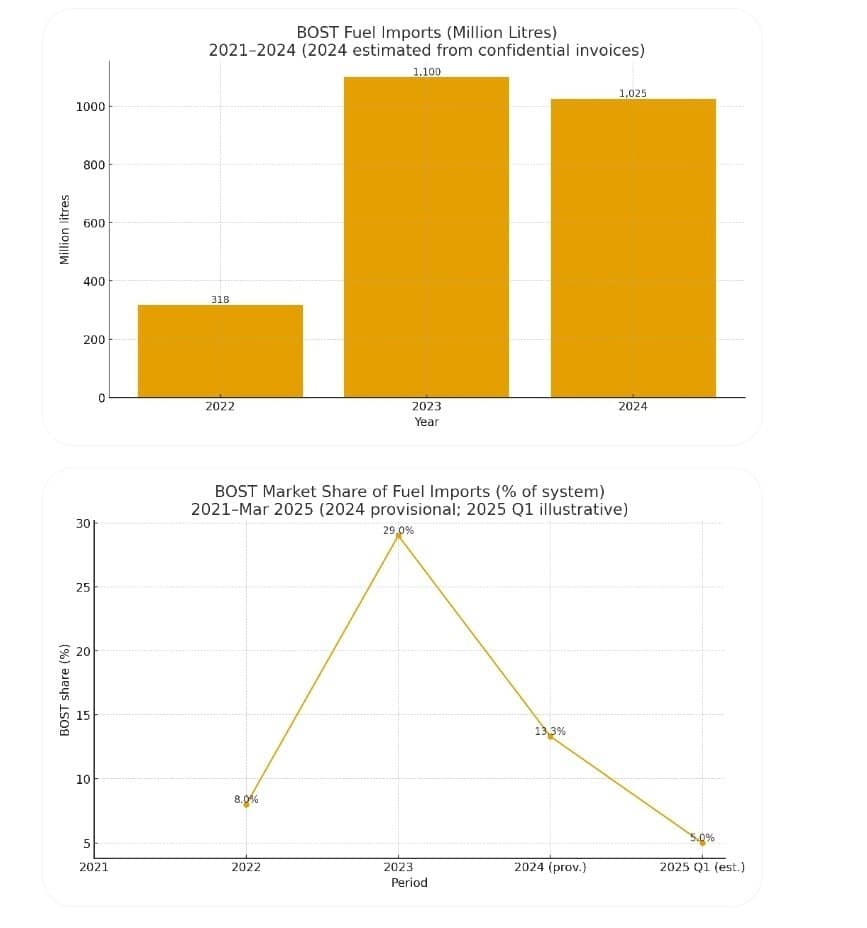

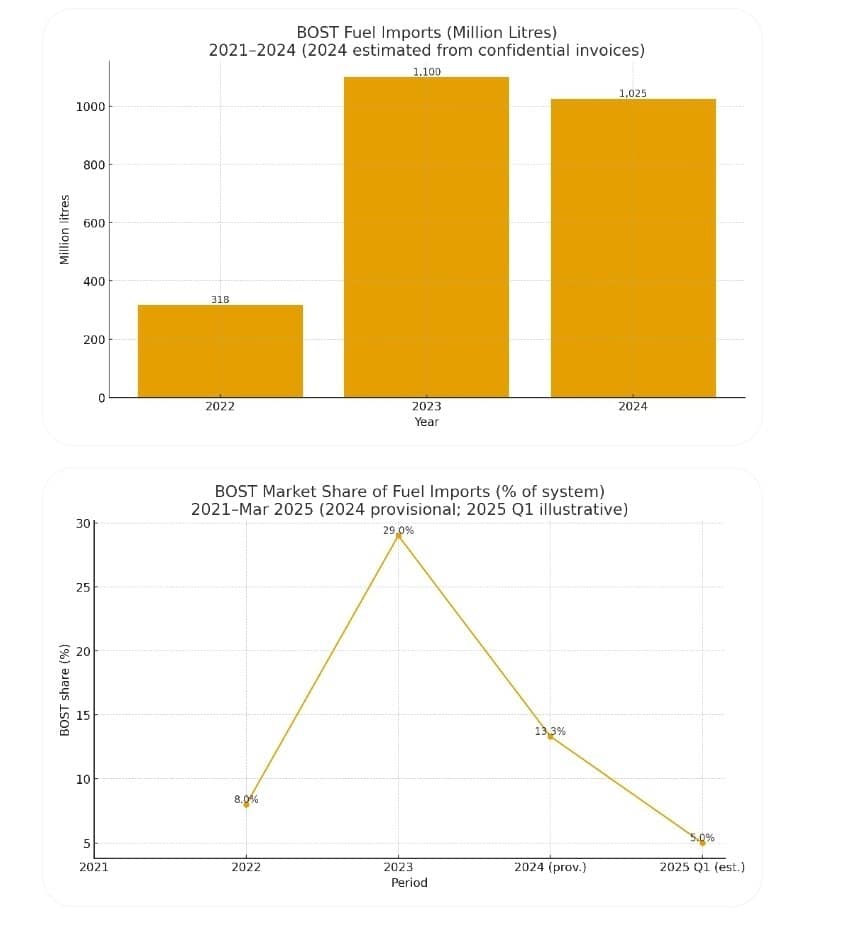

- Attached are graphs that show that G4O’s only impact was to increase BOST’s market share by over 500% (even so, private BDCs still supplied >70% of fuel at the peak of G4O). No other benefit is visible. Currency stability? Zilch. Pump prices? Nada.

- In fact, eliminating the forex losses and brokerage fees and margins could well have benefitted consumers.

- So, we ran a countefactual analysis, which showed just that: without G4O, prices would have been marginally lower.

- Below are two articles that detail aspects of the “katanomic state enchantment” executed through G4O:

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Source link